Results commentary

In Sydney, Andrew Blattman, IPH’s chief executive officer, said: “Our first half result demonstrates the continued success of IPH’s acquisition and integration strategy which has delivered a significant uplift in Underlying earnings for the group with enhanced returns to shareholders.

“We are pleased with the progress of Smart & Biggar since we acquired the business in October last year. Underlying earnings since acquisition were consistent with our expectations and we continue to progress the integration of the business into the wider IPH network, including generating referrals across our group.

“Our business in Asia continued its strong momentum, delivering double-digit earnings growth as we successfully leverage our network across the region.

“Following a period of disruption from the integration of Spruson & Ferguson Australia and Shelston IP, we are focused on initiatives to drive organic growth in Australia and New Zealand, including business development initiatives to increase filings with existing clients and target larger clients with IP remits across multiple jurisdictions, as well as process improvement to support client prospecting.

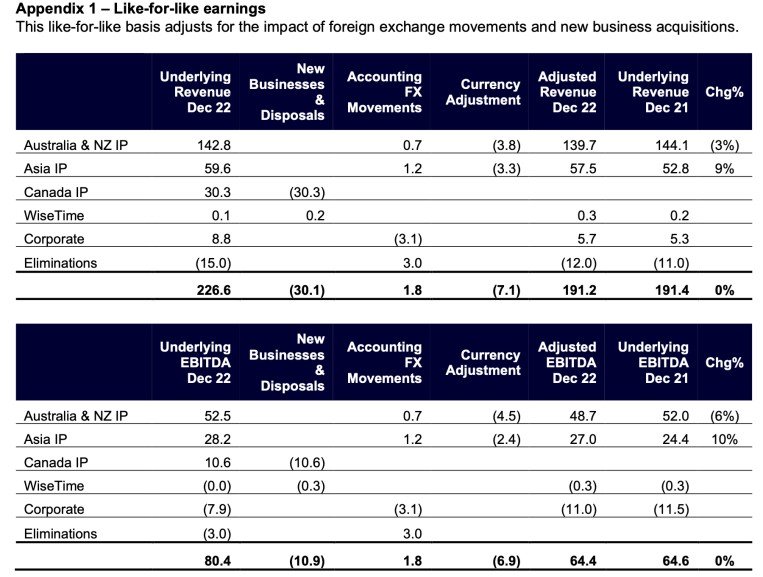

“On a group like-for-like basis (which removes the impact of currency benefit and acquisitions), earnings were steady on the prior corresponding half. This represents a slight improvement towards the end of HY23 from our commentary at the AGM where like-for-like earnings for the first four months had moderated on the prior corresponding period,” Blattman said.

In IPH’s Asianbusiness, like-for-like revenue increased by 9% and like-for-like EBITDA improved by 10%. IPH patent filing growth across its Asia jurisdictions was steady in HY23 compared to the comparative period. Filings were lower in China while IPH experienced filing growth in Hong Kong, Indonesia and Malaysia. Based on preliminary data, the Singapore patent market decreased by 3.0% in CY22 YTD September compared to the previous corresponding period, reflecting a significant decline in filings from the market’s top corporate group (an IPH client). Excluding this group, the market increased by 0.3%. IPH Group filings decreased by 8.6% for the same period reflecting that IPH was more significantly impacted by the decline in filings from this one corporate group. Excluding this client, IPH Group filings increased by 4.3%. The IPH Group maintained its number one patent market share of 23.4% in CY22 YTD September.

Like-for-like revenue in IPH’s Australian and New ZealandIP businesses declined by 3% with like-for-like EBITDA declining by 6%. Travel expenses in HY23 increased significantly compared to the comparative period which was impacted by COVID-related travel restrictions. Excluding this impact, ANZ like-for-like EBITDA would have declined 4% with Group like-for-like EBITDA ahead by 1% on HY22.

Australian market patent filing activity in HY23 compared to a very strong period in HY22 where filings (ex innovation patents) increased by 9% on HY21. Market filings (ex innovation patents) declined by 4.3% in HY23 compared to HY22 while IPH Group filings (ex innovation patents) declined by 7.7% for the same period.

The relative decline in IPH Group filings in Australia reflects a full six-month period of the integration of Spruson & Ferguson Australia and Shelston IP in HY23, compared to one month in HY22, as the integration commenced in December 2022 (we have previously noted the disruptive impact of integration activity on filings). It also reflects lower filings in Griffith Hack in HY23 compared to a strong HY22.

IPH remains the market leader in Australia with combined group patent market share (excluding innovation patents) of 32.4% for the half year period to December 31, 2022.

FY23 priorities

Blattman said IPH would continue to focus on strengthening its international network in FY23.

“The acquisition of Smart & Biggar has significantly enhanced our international reach and we will continue our focus on leveraging the full potential this transaction provides IPH in terms of additional earnings and increased client referrals.

“We will continue to harness our network across Asia while focusing on initiatives to drive organic growth in Australia and New Zealand. These revenue building initiatives are being supported by further enhancing our digital capabilities. These include progressing the IPH Way and client solutions, including a new client portal and client relationship management tools, to improve and simplify our client service offering and generate further efficiencies.

“In the meantime, we will continue to assess further growth options, including potential acquisition opportunities in Canada and other core secondary IP markets,” he said.

Unless otherwise indicated, dollar amounts are in Australian dollars

- Asia IP