“We look forward to Hong Kong’s further development into the regional IP trading centre, optimization of its business environment, and proactive integration into the grand national development plan, joining in building our powerful intellectual property nation,” he said.

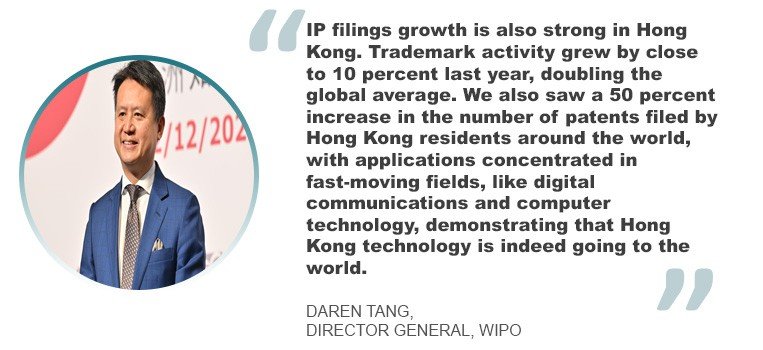

Daren Tang, director general of WIPO, also attended the opening session. In his opening remarks, he referred to the 2022 World IP Indicators Report, published by WIPO in November this year, which shows that global patent, trademark and design filings have surged to new heights, despite the challenges of the pandemic. “Hong Kong’s geography puts it right at the centre of these trends,” Tang said, suggesting that IP offices within a six-hour flying radius of Hong Kong received last year more than 66 percent of all patent applications in the world, as well as over 60 percent of all filing activity related to trademarks and designs. “This growth is also strong in Hong Kong itself,” he said. “Trademark activity grew by close to 10 percent last year, doubling the global average. We also saw a 50 percent increase in the number of patents filed by Hong Kong residents around the world, with applications concentrated in fast-moving fields, like digital communications and computer technology, demonstrating that Hong Kong technology is indeed going to the world.”

Tang said these numbers are more than eye-catching statistics, but highlight that Hong Kong is well-positioned to become a regional IP trading centre. “They also underline the increasingly important role that intangible assets will play in the next chapter of Hong Kong’s economic growth.” He observed three trends that stand out. “First, a growing number of Hong Kong-listed firms will come to derive the majority of their value from intangible assets. Tencent, for example, is one of the most valuable companies listed in Hong Kong and the most intangible asset-rich firm in China. Tencent’s intangible assets are estimated to be worth almost 180 billion US dollars. Indeed, nine of the top 15 Chinese firms ranked by intangible asset intensity now trade shares in Hong Kong, including Alibaba, Meituan, JD and China Tourism Group.”

“Second, intangible asset finance is moving up policy agendas, as governments and companies look towards using IP as a financial asset to help enterprises secure debt and equity financing. Last year, patent and trademark pledge financing in China passed the 300 billion yuan mark, up 40 percent year on year.”

The third trend is that trade in intangible assets continues to surge worldwide. “Between 2010 and 2019, trade flow linked to knowledge and digitalization grew twice as fast as trade flow related to goods, with IP, data and digital services leading the way.”

“Innovation, creativity, entrepreneurship and technology are increasingly driving growth all over the world. Global intangible asset value has crossed the US$70 trillion dollar mark. This will only continue to grow as IP moves from the periphery to the centre of domestic and global economies. Hong Kong and the Greater Bay Area are well-placed to be one of the key centres of an increasingly intangible asset-driven global economy,” he concluded.